Springtime housing market starting to bloom beyond the Bay

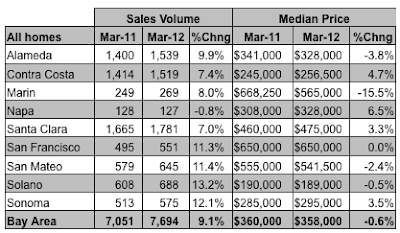

Here in the Bay Area we’ve seen a recovery in the housing market for some time now. Things began to turn around in earnest last year and really have gained traction in 2012. But now as spring is in full bloom, it seems that other parts of the state and nation are getting in on the act. “Green shoots” are evident in cities that previously were showing little signs of life, creating optimism among many industry observers. In a recent news report on NPR, reporter Yuki Noguchi said the mild spring has brought buyers out earlier than usual, and real estate agents are busy around the country. Noguchi interviewed one agent whose clients recently signed a deal on a $1.5 million house in Cape Cod that was notable for several reasons. First, it closed very quickly – “the buyers didn’t hem or haw about the decision,” the agent said. Also, it crossed the million-dollar price threshold, something he hasn’t seen since 2007. The agent says many of his high-end Wall Street clients