Housing market gaining momentum – sales and prices up across the country

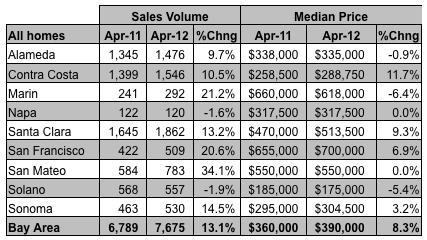

More “green shoots” sprung up for the nation’s housing market this week. On Tuesday, the National Association of Realtors reported that existing home sales rose in April and remain above year-ago levels, and home prices nationwide continued to rise as well. And on Wednesday, the Commerce Department said that sales of new homes rose 3.3 percent in April from March to a seasonally adjusted annual pace of 343,000. That was slightly more than what most analysts had expected. Both reports are just the latest in a recent string of reports that suggest a housing recovery is finally taking hold across the U.S. We’ve certainly seen a good turnaround in many parts of the Bay Area for some time now. But the recovery has been more tepid in some other parts of the country, so these reports come as very encouraging news for the housing market as a whole. The improving existing home sales and prices were across all regions of the U.S., NAR pointed out. Sales incr