Will European and global economic concerns take the wind out of our ‘sales’?

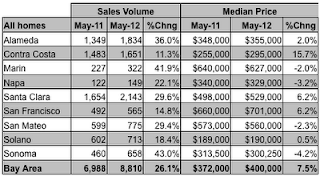

The Bay Area’s housing market certainly has come a long way since the recession, with sales recovering in every price segment from entry-level distressed properties through multi-million-dollar Previews estates. And although prices took a hit from 2008 through 2010, valuations have also turned the corner and have been heading higher once again as well. While the market improvement is to be celebrated, I’m constantly reminded of just how fragile this recovery is – and why we shouldn’t take it for granted. Don’t get me wrong: I’m the last guy to see the cup as half empty. But we continue to face serious economic headwinds that could slow down or even reverse the encouraging gains we’ve seen in the market over the past year or so. I was interviewed by the San Jose Mercury on Wednesday and told reporter Pete Carey that improvement in the Bay Area housing market could quickly turn in the other direction if consumer sentiment grows worse over Euro-zone fears and