Home Appraisal Cost San Francisco (2025 Guide)

How Much Does It Cost to Appraise a Home in San Francisco?

Author: Ms San Francisco Real Estate | Last Updated: September, 2025

Are you buying, selling, or refinancing a home in San Francisco? If so, then you absolutely need to know its true value. This, of course, is where a home appraisal comes in. Specifically, it gives you an expert’s honest opinion on what your property is worth. In fact, a professional appraisal is a critical part of almost every real estate deal in the city.

For this reason, I’m here to help. As a trusted San Francisco real estate agent, I’m Ms. San Francisco Real Estate, and my goal is to help clients understand this process. Above all, I want to give you the clear information you need to make smart choices. So, let’s break down the typical home appraisal costs for 2025.

What Is a Home Appraisal?

First, what exactly is a home appraisal? In simple terms, it’s a professional review of your home by a licensed appraiser. Their main job, therefore, is to determine its current market value.

To do this, they look at many things. For example, they check the home’s condition, size, and location. In addition, they look at any special features and recent sales of similar homes nearby (often called “comps”). As a result, you will almost always need an appraisal for these situations:

- Getting a Mortgage: For instance, lenders need an appraisal to make sure the property is worth the loan amount.

- Refinancing: Similarly, you need one to confirm your home’s value when you get a new loan.

- Buying and Selling: Additionally, both buyers and sellers use appraisals to agree on a fair price.

- Legal Matters: Finally, for dividing assets in a divorce or settling an estate, an appraisal provides an official value.

Average Cost of a Home Appraisal in San Francisco in 2025

Now, let’s talk about the cost. In San Francisco, a standard home appraisal usually costs between $600 and $1,200. However, that price can certainly change, as it depends on a few important factors.

Key Factors That Change Appraisal Costs

- Property Size and Complexity: To begin with, bigger or more unusual homes take more work. As a result, they cost more to appraise. This includes large homes, multi-unit buildings, or historic properties.

- Location in SF: Furthermore, different neighborhoods have very different home values. For this reason, an appraiser needs deep local knowledge, which in turn affects the fee.

- Type of Appraisal: The reason for the appraisal also matters. For instance, a simple conventional appraisal costs less than a more detailed FHA, VA, or estate appraisal.

- How Fast You Need It: Lastly, if you need the report quickly, you can pay extra for a rush service.

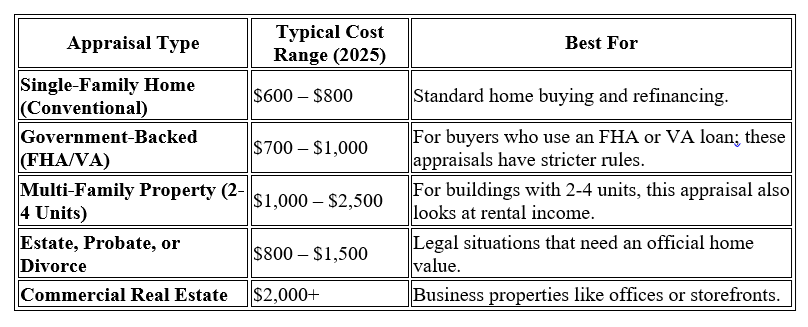

San Francisco Appraisal Costs by Property Type

To be more specific, different appraisals have different price tags. The following table provides a simple breakdown of what you can expect to pay in San Francisco.

Why Are San Francisco Appraisal Fees Higher?

So, why do appraisals cost more in San Francisco? It mainly comes down to the city’s unique and expensive market. For one thing, appraisers have to do a lot of research because the homes and neighborhoods are so diverse. In addition, homes here are very valuable. Consequently, this means appraisers have more risk, and that risk is factored into their fee.

How to Prepare for Your Home Appraisal

While you can’t change the appraiser’s opinion, you can certainly help them see your home at its best. Therefore, here are four simple tips:

- Gather Your Paperwork: First, give your appraiser a folder with your property survey, a list of recent upgrades (with dates and costs), and any HOA information.

- Clean and Declutter: Next, remember that a tidy home always looks better. For this reason, make sure the appraiser can easily get into all rooms and closets.

- Finish Small Repairs: Then, fix any minor issues like a leaky faucet or a broken doorknob. Indeed, these small fixes show that the home is well-cared-for.

- Point Out Key Features: Finally, be ready to show off recent improvements, such as a new kitchen, updated windows, or a remodeled bathroom.

Navigate the SF Appraisal Process with an Expert

With over 20 years of experience, I am known as a top real estate agent in San Francisco. Because I know local property values so well, I can protect you from overpaying or underselling. Therefore, working with an expert agent gives you clear advantages:

- Honest Home Value Estimates: First of all, I can give you a good idea of your home’s value before the appraiser even arrives.

- A Network of Professionals: In addition, I can recommend trusted local appraisers who know your neighborhood.

- Expert Advice: Furthermore, after you get the report, I’ll help you understand it and plan your next steps.

Frequently Asked Questions (FAQ)

1. Who pays for the home appraisal?

Generally, when you buy a home, the buyer pays the appraisal fee. If you are refinancing, on the other hand, the homeowner pays for it.

2. How long does a home appraisal take?

The visit itself is quick, often under an hour. Afterward, the appraiser researches and writes the report, which usually takes 5 to 10 business days.

3. Is an appraisal the same as a home inspection?

No, they are definitely different. An appraisal is about the home’s value for the lender. A home inspection, in contrast, is about the home’s condition for the buyer.

4. Can I just use a Zillow Zestimate?

You should think of sites like Zillow or Redfin as only a starting point. While they give you a rough, computer-generated guess, these estimates are often not accurate. Most importantly, lenders will not accept them for a loan. Instead, you must have a report from a licensed appraiser.

The Takeaway: Is a San Francisco Home Appraisal Worth It?

In short, is a home appraisal worth the cost in San Francisco? Yes, absolutely. In fact, it’s a small price to pay for confidence and a fair deal. Ultimately, the peace of mind and negotiating power you get are well worth the fee.

Ready to navigate the San Francisco real estate market with confidence? Then contact Ms. San Francisco Real Estate today for a consultation and expert guidance on your property journey.

Comments

Post a Comment