Home Valuation vs. Appraisal in San Francisco: What’s the Difference? (2025)

Home Valuation vs. Home Appraisal – What’s the Difference in San Francisco?

Author: Ms San Francisco Real Estate | Last Updated: December, 2025

Frequently, homeowners ask about value. Specifically, they ask, “What is my home worth?” However, the answer depends on the method. Basically, valuations and appraisals are different. Although they sound similar, they are not the same.

Understanding this distinction is vital. In San Francisco, mistakes are costly. Therefore, knowing the difference prevents underpricing. Also, it helps you maximize profits. Whether you sell or refinance, accuracy matters.

Proudly, Ms. San Francisco Real Estate is here. As a trusted agent, I guide clients daily. Below is a simple breakdown.

🏡 What Is a Home Valuation?

First, let’s define a valuation. Essentially, it is an estimate of market worth. Typically, experts or algorithms create it. Homeowners use this to track equity. Also, they use it to plan a sale.

Commonly, valuations come from:

- Online Estimates: For example, Zillow or Redfin.

- AVMs: Basically, these are automated models.

- CMAs: Specifically, a report from a local realtor.

- Consultations: Often, agents offer these for free.

Ms. San Francisco Real Estate is different. Instead of guessing, we use data. Consequently, you get a precise number.

📋 What Is a Home Appraisal?

In contrast, an appraisal is formal. Legally, a licensed pro must do it. Crucially, this is an independent test.

Generally, lenders require them. Why? Because they need to verify value. Therefore, it serves as a legal document.

Appraisers evaluate these factors:

- Comps: First, they check recent sales.

- Condition: Next, they inspect for damage.

- Specs: Also, they measure the size.

- Location: Finally, they check the zip code.

⚖️ Key Differences: Valuation vs. Appraisal

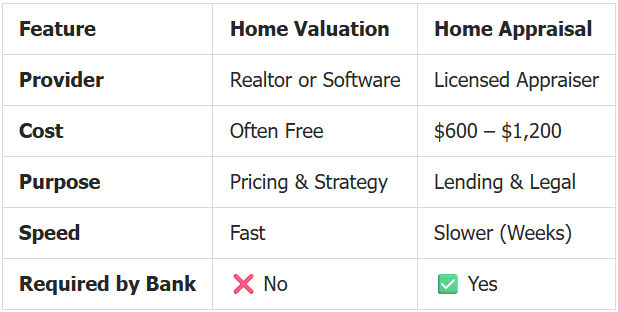

To clarify, let’s compare them. Below is a quick table.

As you can see, they differ greatly. Thus, you must choose wisely.

🌉 Why This Matters in San Francisco

Importantly, our market is unique. In fact, it is hyper-local. Sometimes, values vary on the same block. For instance, parking changes the price. Also, views add value.

Unfortunately, online tools miss this. Therefore, you need a human expert. Neighborhoods like Noe Valley are complex. Consequently, an agent is your best asset.

When to Use a Valuation

Generally, use a valuation when:

- Planning to sell.

- Deciding on repairs.

- Researching cash offers.

- Checking your equity.

When to Use an Appraisal

Conversely, use an appraisal when:

- Buying a home.

- Refinancing a loan.

- Handling a divorce.

- Removing PMI costs.

💰 Selling Fast or For Cash?

Maybe you want to sell fast. Or, perhaps you want cash. Even then, value matters.

Otherwise, you might lose money. Currently, Ms. San Francisco Real Estate helps you.

- First, we compare investor offers.

- Next, you avoid low prices.

- Finally, we choose the best path.

🤝 Why Work With Ms. San Francisco Real Estate?

Navigating this market is hard. Fortunately, you have help. Homeowners choose us because:

- First, we are licensed experts.

- Additionally, we track daily rates.

- Most importantly, we are honest.

Final Thoughts

In summary, clarity is power. Understanding these terms gives you confidence. Ultimately, it helps you win.

Ms. San Francisco Real Estate is ready. So, contact us today. Let’s protect your investment.

Comments

Post a Comment