SF Home Appraisals: A First-Time Buyer’s Guide (2025)

First-Time Buyer’s Guide to Appraisals in San Francisco

Author: Ms San Francisco Real Estate | Last Updated: November, 2025

Buying your first home in San Francisco is a thrilling milestone. However, the process can also feel overwhelming. For example, you have to navigate open houses and manage finances. Because the Bay Area market is so competitive, understanding the technical steps is vital. Specifically, you must understand the home appraisal.

A clear understanding of appraisals helps you make confident decisions. Therefore, this knowledge protects your investment.

Fortunately, Ms. San Francisco Real Estate is here to guide you. Below is a breakdown of what appraisals are, why they matter, and how to handle them like a pro.

🏠 What Is a Home Appraisal?

Fundamentally, a home appraisal is an independent report. Basically, it determines the current market value of a property. Typically, a licensed professional performs this assessment.

Lenders use appraisals for safety. Specifically, they need to confirm that the home’s price matches its true value. During the process, the appraiser evaluates several key factors:

- Condition: First, they check the physical state of the house.

- Location: Next, they analyze the specific neighborhood. For example, values differ between the Mission District and Pacific Heights.

- Size: Also, the square footage and layout are measured.

- Comps: Finally, they look at “comparable sales” of nearby homes.

In San Francisco, accurate appraisals are crucial. Ultimately, they protect you from overpaying in a heated market.

💡 Why Do Appraisals Matter?

For first-time buyers, the appraisal is a “make or break” moment. Primarily, it dictates your loan eligibility.

Here is why this step is so important:

1. Protecting the Lender (and You)

First, the bank wants to protect its money. For instance, if you stop paying the mortgage, the bank needs to know it can sell the home. Consequently, they will not lend more than the appraised value.

2. The “Appraisal Gap” Risk

In San Francisco, bidding wars are common. Often, buyers offer more than the asking price. However, if the appraisal comes in lower than your offer, you have a “gap.” Therefore, you might have to pay the difference in cash.

3. Market Reality Check

Finally, the appraisal reveals trends. Moreover, it highlights neighborhood demand. Thus, it confirms if the price reflects the current market reality.

🔍 The San Francisco Appraisal Process

The process is standard. However, the timeline moves fast. Generally, it follows these four steps:

1. Scheduling

Once your offer is accepted, your lender takes action. Then, they hire a licensed San Francisco appraiser. Importantly, the appraiser works for the lender, not for you.

2. The On-Site Visit

Next, the appraiser visits the home. Specifically, they inspect key aspects. For example, they check structural integrity and renovations.

3. Analysis of “Comps”

Subsequently, the appraiser looks at data. For instance, they review similar homes sold in the last 90 days. In San Francisco, this is tricky because neighborhoods change quickly.

4. The Final Report

Finally, you receive the report. Essentially, this document states the final value. At this point, your lender decides on the loan amount.

📉 What If the Appraisal Is Low?

Admittedly, this is the biggest fear for buyers. Since San Francisco is competitive, sale prices often exceed appraised values. If the number comes in low, do not panic. Fortunately, you have options.

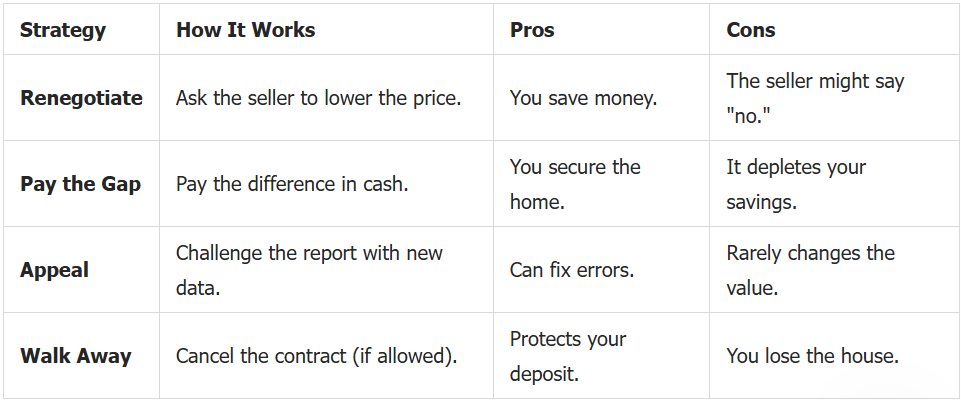

Here is a comparison of your strategies:

Moreover, Ms. San Francisco Real Estate helps you navigate these tough choices. Together, we ensure you stay aligned with your financial goals.

📍 Neighborhood Factors in San Francisco

Undoubtedly, San Francisco is unique. Therefore, generic calculators do not work here. Instead, appraisers consider specific local details, including:

- Micro-climates: For instance, is the home in the fog belt or the sun belt?

- Transit: Also, is it close to BART or Muni lines?

- Topography: Additionally, does the home have a view?

- Zoning: Furthermore, are there restrictions on renovations?

Luckily, a knowledgeable local realtor helps you spot these factors early. Consequently, you avoid surprises later.

🚀 Pro Tips for First-Time Buyers

To succeed, you must be prepared. Here are four tips for your first purchase:

- Do Your Homework: First, research prices in your favorite neighborhoods.

- Trust Your Agent: Next, work with someone who knows San Francisco deeply.

- Read the Report: Also, do not just look at the final number. Read the details.

- Think Long-Term: Even if the appraisal is tight, consider the future value.

Work With Ms. San Francisco Real Estate

Buying a home is a journey. However, you do not have to walk it alone. In fact, Ms. San Francisco Real Estate combines deep market knowledge with genuine care.

Specifically, we provide comprehensive support, including:

- Guidance on property valuation.

- Strategies for bidding wars.

- Connections to trusted lenders.

- Expert negotiation if the appraisal is low.

Final Thoughts

Ultimately, understanding appraisals is essential. With the right knowledge, you can make confident decisions. Ms. San Francisco Real Estate is ready to help you secure your dream home.

So, contact us today. Let’s start your journey in the San Francisco housing market.

Comments

Post a Comment