Top 6 Factors Influencing Your San Francisco Home Value (2026)

Top Factors That Influence Your San Francisco Home Value Estimate

Author: Ms San Francisco Real Estate | Last Updated: February, 2026

Currently, San Francisco real estate is complex. In 2026, buyers are picky. Therefore, accurate valuation is vital. Whether selling or refinancing, you need data. Specifically, you must know what drives the price.

Basically, an estimate is not a guess. Instead, it is a calculation. Appraisers look at specific traits. Below is a breakdown of the top factors.

📍 1. Location, Location, Location

Undoubtedly, this is the biggest factor. In San Francisco, the neighborhood dictates the baseline. For example, a home in Pacific Heights costs more than one in the Outer Sunset.

Key location drivers include:

- Prestige: Specifically, areas like Nob Hill command premiums.

- Transit: If you are near BART, value rises.

- Walkability: Also, proximity to parks and cafes matters.

Consequently, the zip code sets the stage. Then, the house plays its part.

📐 2. Property Size and Layout

Next, size matters. However, it is not just about square footage. Crucially, the layout must flow.

What buyers look for:

- Bedrooms: Generally, more rooms mean more money.

- Flow: Ideally, the floor plan feels open.

- Outdoor Space: In SF, a yard is gold.

Surprisingly, a small home with a good layout often beats a large, awkward one. Thus, usability is key.

🛠️ 3. Condition and Upgrades

Visibly, the condition impacts the first impression. Appraisers look past the decor. Instead, they check the “bones.”

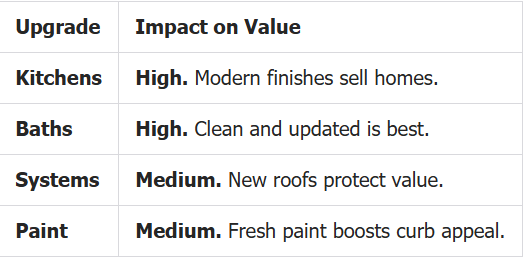

Therefore, deferred maintenance hurts you. Conversely, smart upgrades pay off. So, fix the leaks before listing.

📊 4. Market Trends & Economy

Constantly, the market shifts. In 2026, economic factors play a huge role. Specifically, interest rates affect buyer power.

External factors include:

- Rates: If rates rise, prices may soften.

- Jobs: Currently, tech growth drives demand.

- Inventory: When supply is low, prices spike.

Ms. San Francisco Real Estate tracks these daily. Thus, we know the right time to sell.

🏘️ 5. Comparable Sales (Comps)

Technically, this is how we find the number. Simply, we look at “comps.” These are recent sales nearby.

A good comp matches your:

- Size: Ideally, within 10% of your square footage.

- Age: Also, similar build dates.

- Distance: Preferably, within 0.5 miles.

However, adjustments are made. For instance, we add value for a view. Then, we subtract for a busy street. Ultimately, the data tells the truth.

💎 6. Special Features

Finally, the “X-factors” count. In San Francisco, certain traits are rare. Therefore, buyers pay extra for them.

High-value features:

- Views: Especially of the bridge or bay.

- Parking: Undoubtedly, a garage adds massive value.

- Tech: Increasingly, smart homes are preferred.

If you have parking, you win. Consequently, your appraisal will reflect that.

❓ FAQs: SF Home Values

How much does an appraisal cost? Typically, between $400 and $700. It depends on the size.

Can I increase my value before selling? Yes. Focus on kitchens and paint. Also, clean up the yard.

Do cash offers change the value? No. Appraisers look at the market value. However, cash closes faster.

Does a view really matter? Absolutely. In SF, a view can add 20% or more.

Final Thoughts

In summary, value is a mix of art and science. However, you don’t have to guess. Ms. San Francisco Real Estate is here to guide you. So, contact us for a professional estimate today.

Comments

Post a Comment